Trains last for a long time, and their first cost is usually a small proportion of the whole life cost. This was the topic examined at an Institution of Mechanical Engineers Railway Division seminar in November 2023, where the issues facing freight, passenger, and metro rolling stock were discussed.

At first sight it might appear that these sectors have quite different issues, but it soon became clear that the only real difference is in ways and means and freedom of action. This article describes the situation on the main line and a companion article discusses some of the issues facing TfL.

Freight

John Smith, founder and chief executive of GB Railfreight (GBRf), gave the keynote address, outlining the growth of GBRf from a startup in 1999 with just six locomotives, supported by Railtrack which wanted competition for engineering trains, still the largest single market for UK freight trains. Since then, GBRf has grown and has around one third of the UK rail freight market, operates many special passenger trains, and operates new trains during transit, testing, and commissioning.

This success comes from leadership that values behaviours including good communications, professionalism, and enjoyment, and profits which provide investor confidence. GBRf is a freight operating company and not a rolling stock owner/maintainer. Its assets are leased and maintenance is contracted, but GBRf works very closely with suppliers to ensure reliability, availability and affordability.

John praised the performance of GBRf’s workhorse, the Class 66 locomotive, and overhaul work by Electro-Motive Diesel Ltd (EMD), but he said there’s more to do. It’s no good, for example, if a loco is classed as available having been outshopped from EMD in Doncaster if it’s needed in Fort William. John said that headline availability from the workshop of 92% can be more like 70% when the location of the load is taken into account.

Maintenance/overhaul was traditionally carried out on the engine, other components, and bogies while the loco stays in the workshop. Much better, John said, to exchange these items for overhauled parts and send the loco out more quickly. More spares are needed but the cost is small compared with the benefit of improved availability. John also showed new GBRf maintenance facilities being established to further improve loco availability and modernise wagon maintenance which has not changed much in the last 50 years. All this requires a keen eye on both costs and revenue. John added that he recognises that assets are vital but are merely tools needed to deliver a great service to freight customers.

Sustainable freight locos

Bob Tiller, GBRf’s asset strategy director, explained how detailed examination of locomotives’ performance in service has led to many changes in the maintenance schedule. Class 66 locos used to be maintained to the manufacturer’s instructions but, following the review, much less maintenance is now carried out and reliability has improved with availability, improved by component exchange described above.

Some activities have had to be carried out more frequently to take account of changed operational context. For example, Class 73 locomotive wheelsets used to last around six years between change when operating on Southern but, when operating in Scotland on lines with more curves, wheelset change has to be carried out every three years. Another important requirement is not to schedule maintenance during peak demand periods.

Bob described how expensive failures in service can be. GBRf lets full-service maintenance contracts, and it has chosen to incentivise reliable performance by including a provision for a payment from the maintainer to GBRf if a train is delayed by a locomotive or wagon fault. Whilst it costs a little more up-front, it is a huge carrot to the supplier.

He turned to future freight motive power, recognising that the Class 66 is a good modular locomotive, but its engine cannot be developed further to conform to the latest emissions regulations. As GBRf is a private company it can choose the locomotives it wants. Bob saw the Stadler Eurodual machine at Innotrans in 2018 and, after much discussion/negotiation, a UK gauge concept was developed. This is the Class 99. Costing around £4.7 million each, it is a Co-Co electric loco with a diesel engine nearly as powerful as that on a Class 66.

A contract was placed for 30 locos with an option for another 20. Whilst the locomotives are expensive, where electric power can be used carbon credits can be obtained both by GBRf and its customers. Bob added that the loco is modular and as more electrification comes on stream, the diesel sub-system could be replaced by batteries. It is due into service in early 2025.

Bob’s opinion is that hydrogen is not the way forward with challenges concerning the quantity required, refuelling, storage and manufacture, and, while useful, biofuels are relatively high-cost with uncertain supplies. He added that 25kV is the answer with a bi-mode addition – engine or battery.

He did suggest that there might be more of a role for battery power for freight than merely last mile operation to/from freight yards. He has seen a CRRC manufactured loco in Thailand which, with two battery trailer wagons, has a range of circa 500km. Bob thought that a UK version without the trailers might have a range in the order of 200km. Summing up, GBRf spends approximately £32 million on diesel fuel and sees the future in the Class 99 and for battery freight locomotives, but Bob did not rule out a Class 66 converted to have a modern electric converter and bi-mode traction package.

Main line passenger

When privatisation was originally planned in the early 1990s, it was quickly realised that the plan to have comparatively short franchises might present problems if the passenger operators – Train Operating Companies (TOCs) – owned the rolling stock. The architects turned to the notion of dedicated companies to own the trains which would lease them to the TOCs. Three initial leasing companies were set up – Angel Trains, Eversholt Rail, and Porterbrook, and more Rolling Stock Companies (ROSCOs) have entered the market since then. It eventually became clear that new rolling stock was only likely to be ordered as part of a refranchise. A train operator, two ROSCOs, and a representative of the Great British Railways Transition Team contributed.

Collaboration

Dr Linda Wain, engineering director at LNER, spoke about how she felt we need to adopt a holistic approach to whole life costing rather than in silos of rolling stock, infrastructure, etc. Linda presented some TOC challenges to having a 30-year train availability and reliability contract involving four parties, but stated this was why LNER was delighted to have established a pioneering Relationship Charter with Agility Trains and Hitachi Rail which outlines common values and high standards for collaboration and interaction.

Working together as partners is a key part of delivering the best service. Essentially, the Charter is a commitment to working together to reach shared competitive goals and to achieve operational benefits through a spirit of mutual trust and openness.

More collaboration

Paul Sutherland, client services director at Eversholt Rail presented an owner’s view. Eversholt Rail owns nearly 2,800 passenger vehicles and 83 freight locos which are leased to nine TOCs and three Freight Operators. Unusually it also acts as asset manager to the Class 700 Thameslink fleet on behalf of its owner Cross London Trains.

In context of support and whole life cost, Paul segregated his fleet into legacy and new. Broadly, legacy covers trains made with steel bodyshells, on train management system (TCMS), separate light and heavy maintenance regimes, some standalone software systems, some discrete remote condition monitoring (RCM) capability, and in house/in industry knowledge. In contrast new fleets tend to have aluminium bodies, TCMS with integrated software systems and embedded RCM, merged light and heavy maintenance regimes, and rely on the original supplier(s) for support.

What does this mean in practice? For the legacy fleets, which were those in place when the ROSCO/TOC arrangement was set up, this means simple contractual responsibilities such as ROSCO being responsible for heavy maintenance and TOC being responsible for light maintenance. More modern trains need more sophisticated arrangements which involve TOC, ROSCO, and OEM, with the latter sometimes responsible for maintenance.

Paul suggested that the prizes the industry is chasing haven’t changed. People want to do the right maintenance at the right time to deliver safety, availability, and reliability at minimum cost, but technology, regimes, and contractual relationships have all changed and there’s a much greater reliance of knowledge held “elsewhere” as Paul put it. While the different parties (ROSCO/TOC/OEM) may want to optimise maintenance, each party bears different risks and different time horizons of interest.

For example, a TOC might only have three years left on a lease whereas a ROSCO wants to preserve value for another 30 years asset life. That said, all parties have an incentive to reduce cost, but availability and reliability also need to be delivered, and no one likes surprises.

Like Linda Wain, Paul emphasised the importance of collaborative working including having a shared vision between TOC, ROSCO, and OEM on where you want to take the fleet, and openness about risks and benefits to each party. Paul emphasised the importance of making benefit share and risk allocation crystal clear in contracts, as this can often be a blocker to progress. Another important factor is to grow asset knowledge together.

Regarding TCMS and RCM, these and other modern technologies have helped to extend maintenance intervals, but Paul expressed concern about how these technologies will be supported when the spectre of obsolescence rears its ugly head – another important risk that must be allocated and managed.

Paul’s takeaways included staying close to the asset and finding out where the knowledge is, especially in the supply chain, to understand sub-systems and to help maintenance optimisation. He identified the risk that components not routinely examined might suddenly fail. He added that it is important to understand the incentives of all the parties, collaborate and have a joined-up vision. Whilst the contractual environments are different, these should not be a hurdle to continuing to strive to optimise maintenance.

Continued service operation

David Buckley, head of fleet at Angel Trains introduced the concept of Continued Service operation (CSO).

Because of new build delays, infrastructure delays, or increased demand, trains might be required to stay in service beyond their projected life. Angel Trains developed a structured 11-step process, which has been applied to all of Angel Train’s fleets more than 30 years old, most of which have steel bodyshells. David said that the process had shown that the biggest risk is the integrity of the vehicle body, largely due to corrosion, which impacts on compliance, crashworthiness, reliability, availability, cost, and reputation.

David outlined a case study on Class 317 trains which were required to carry on for longer than expected. Assessments included a structural finite element analysis, and a corrosion management regime. Inspection showed some wiring degradation, obsolescence was an issue for some components, and the extra time in service meant that some modifications were carried out to comply with the Persons with Disabilities and with Reduced Mobility Technical Specification for Interoperability.

As David and his colleagues learn from past CSO assessments, the technique is gradually being used earlier in the life of fleets to assess, among other things, the scope of imminent refurbishment or other heavy maintenance interventions.

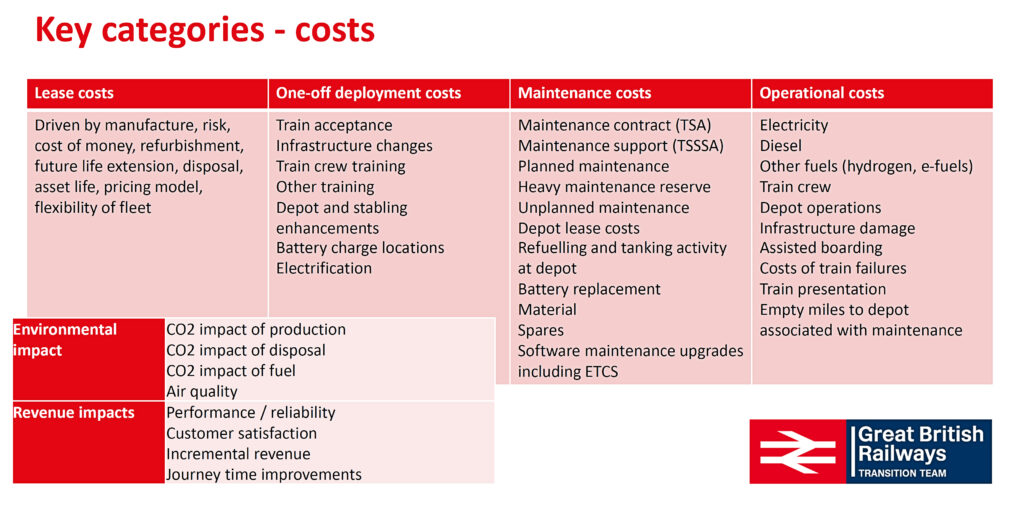

Rich Fisher, head of strategic planning at the Great British Railways Transition Team (GBRTT), examined whole life cost issues in the context of a long-term strategy. Echoing this article’s opening remark, Rich said his work aligns closely with what TfL is doing for its fleets, although the different structure on the mainline railway with the assets in private ownership means an enabling rather than directing approach is needed. With upfront costs representing only a small proportion of a fleet’s overall cost, it is important that the trade-off between short-term gain and long-term performance is properly made. Rich said that there had been recent examples where decisions on fleet procurements had not been made on this basis.

Rich emphasised whole-system thinking. Rolling stock decisions can lead to costs elsewhere, such as infrastructure maintenance, energy, performance, depot capability, and power supply. For example, as has been reported in these pages, providing a long block train can have a profound and expensive impact on depots. As well as cost, value should be considered such as passenger environment vs revenue, train design vs performance, and whole life carbon (build, operation, and disposal/recovery).

Uncertainties make it even more challenging, including future cascade or conversion, redeployment, refurbishment, market behaviours and the cost of capital tipping decisions for, or against, new trains.

A good business case to invest should outline trade-offs between different options, impact on infrastructure/whole system, and a realistic assessment of the do-nothing option by, for example, not incurring every single piece of heavy maintenance for a one-year life extension.

Rich’s team is aiming to develop an approach and set of tools to support better understanding and analysis of whole life costs. The objective is consistency, good practice and better decision making as proposals are developed by the market. It will be developed with the industry, not imposed, but it will allow individual procurements to be considered in a consistent framework. There are numerous challenges to this modelling approach, notably: how to value flexibility to redeploy following as yet uncommitted route electrification, market behaviour which means unclear as to future use, comparison of the full range of options (life extension or cascade – 10 years vs new – 35 years), and the cost of finance which could tip the balance between new or refurbished trains.

Moreover, risk identification and management should be an active whole life process, not just for procurement. Rich added that the different contracting arrangements (e.g., maintenance) mean that obtaining data for benchmarking is challenging. GBRTT is working with the Department for Transport, RSSB, and the wider industry to deliver a whole life cost guidance note for use by operators.

Conclusion

There was evidence woven into the presentations that many train procurements have been focussed on short-term rather than long-term outcomes. Rail Engineer wonders whether the constraints of public procurement rules, together with the pressure on procurement teams during franchise bids lead to sub optimal solutions. Certainly, many in the audience envied GBRf’s and Bob Tiller’s ability to choose the supplier they wanted and to negotiate a price they could afford.

The passenger railway has seen almost as many strategies and plans as there are TOCs, ROSCOs and train builders. The presentations identified ways of working cooperatively and GBRTT’s work will hopefully deliver a toolkit that will help.

Photos and captions by the speakers and the writer unless otherwise shown.