Malcolm Dobell & David Shirres

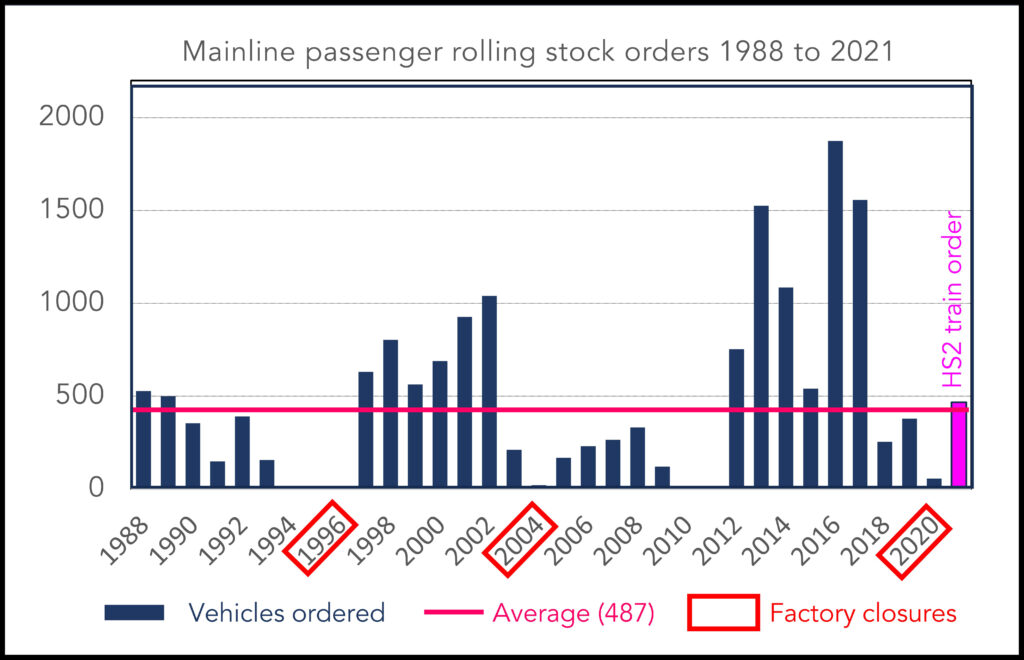

In July, the Railway Industry Association (RIA) published its report ‘The UK Rolling Stock Industry – making 2023 the year of opportunity not crisis’. This showed how ‘boom and bust’ train procurement resulted in factory closures and downsized the UK’s train upgrade capability. Furthermore, as in any industry, such large variations in demand leads to inefficiency, and higher cost.

In 2011, the UK had one new-build factory. Following a glut of 7,300 vehicles ordered between 2012 and 2017, there are now four. These factories, and thousands of jobs, are now at risk as the only train orders placed since 2019 are those for HS2 and 10 x 10-car tri-mode trains for LNER. The latter ended the four-year hiatus in rolling stock orders (excluding HS2).

By 2030, around 2,600 vehicles will be over 35 years old. New trains are needed, not only to reduce costs, but to improve passenger services and meet decarbonisation commitments. From, say, 2027-2028 onwards, the UK market for rolling stock is predicted to be the second largest in Europe. The question is whether UK rolling stock plants can survive their current shortfall of work until then.

On 6 December, the Parliamentary Transport Select Committee (PTSC) 2023 heard evidence about rolling stock procurement. The witnesses included David Clarke, technical director of the Railway Industry Association (RIA), Nick Crossfield, Alstom’s managing director UK and Ireland and Malcolm Brown, chief executive officer of Angel Trains.

The PTSC heard of the costs and inefficiencies associated with ‘boom and bust’ procurement which during the recent glut peaked at nearly 2,000 vehicles per year. David Clarke advised that if it was possible to even out demand, around 600 vehicles per year would be required. Malcolm Brown and others also considered the need to consider the railway as a system, likely future train orders, and how the current hiatus in orders threatens rolling stock plants.

Alstom’s Nick Crossfield gave evidence highlighting a very worrying situation. Alstom’s plant at Derby is to run out of work at the end of January 2024. Hitachi has also reported that it has written down £60 million of value on its Newton Aycliffe plant because of lack of orders.

What’s going on? Rail Engineer surveys what’s currently in production, what capacity exists, the likely prospects, and why this situation has arisen.

Background

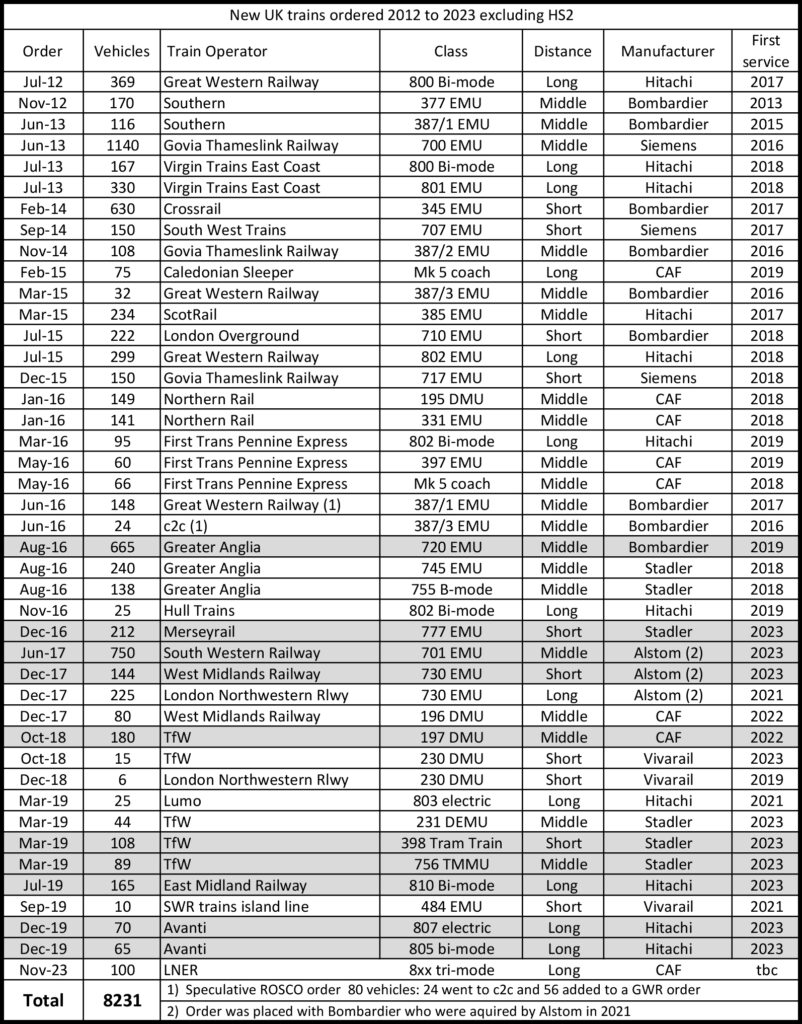

Cheap finance and the introduction of quality measures into train operating franchise competitions about 11-12 ago years incentivised franchises to buy new trains. Together with the Inter-city express and Thameslink programmes, some 8,000 new vehicles had been ordered in a five-to-seven-year period by 2019. This was described in the 2004 to 2023 rolling stock retrospective in issue 200 (Jan/Feb 2023). The updated table from that article is included here to reflect continued delays to some of the more recent orders.

As the Covid pandemic made train franchises financially unsustainable, the Department for Transport (DfT) now directly manages franchise companies and has taken over the responsibility for rolling stock procurement.

Building on David Clarke’s remarks above, the UK fleet – main line and metro – amounts to about 21,000 vehicles, with a nominal life of 36 to 40 years. This represents a build rate of about 600 vehicles per year in the unlikely event that steady state could be achieved. The 2010’s bulge, which peaked at nearly 2,000 vehicles a year, was a distortion, added to by a number of modern fleets being sidelined (30 x 4- car Class 379) or slated for sidelining (37 x 4-car Class 350/2) to which can now be added the 14, class 68 locomotive/Mark 5-carriage fleet. The cost of the resultant wasteful surplus of trains is likely to be hundreds of millions of pounds and is another downside of boom and bust train procurement.

Orders and delivery

Since Rail Engineer last reported on rolling stock procurement, Covid and other issues have delayed train introduction. Hence between 1,500 and 2,000 vehicles await completion and/or entry into service on West Midlands Railway, London NorthWestern Railway, East Midlands Railway, Avanti West Coast, Transport for Wales, MerseyTravel, and SouthWestern Railway.

For Metros, the first of Glasgow subway’s new trains, delivered in 2019, finally entered service in December 2023. London Underground’s Piccadilly line and Newcastle’s new trains are due to enter service in 2025 and 2024 respectively.

Capacity and work in progress (in order of date of establishment of the factory) is described below.

Alstom. Although some may disagree, the Alstom plant probably manufactures the highest value of its product in the UK than any of the other suppliers. However, at the PTSC meeting Nick Crossfield said that it was just weeks away from this ending, with the last of the current orders for Aventra EMUs due to roll out of the factory in early 2024. The only work on the order book is the work arising from the joint Hitachi/Alstom contract for the HS2 fleet, but this work is not due for another couple of years. As described below there was a risk that manufacture at Derby may be reduced to an assembly operation for parts made elsewhere.

Hitachi. The Newton Aycliffe plant was established to assemble Hitachi’s AT300 EMUs and bi-mode units for inter-city operation (Class 8XX) and AT200 outer suburban EMUs (Class 385). Later facilities were installed to manufacture car bodies using friction stir welding techniques which are in use for current production of Classes 805 and 807 for Avanti West Coast, and Class 810 for East Midlands Railway. Once these orders are complete by approximately the end of 2024, there is the order for the HS2 rolling stock. However, recent changes to HS2 make changes to that order likely, meaning that there will probably be a delay.

CAF Newport. The Class 197 continues to be assembled although introduction into service of these and West Midlands’ Class 196 is much slower than originally expected. It is understood that the LNER tri-mode trains will be based on TransPennine Express’ Class 397, and these will be assembled at Newport.

Siemens. The Goole plant has been set up to assemble tube trains for London Underground. As reported in issue 205 (Nov/Dec 2023), Siemens expects to assemble at least half the 94 x 9-car Piccadilly line trains at Goole (an announcement in December 2023 paves the way for even more to be built there) and there is an option for another 36 trains for the Bakerloo line. Siemens also has a component overhaul facility on site with plans for further expansion.

Though these prospective orders are good news in the medium term, they will not save threatened factories as it takes around three years for an invitation to tender to become work on the shop floor. This is a year for procurement and around 18 months to mobilise production. It is also possible that orders might go to suppliers outside the UK.

Prospective orders

Prospects for orders totalling between 2,500 and 3,000 vehicles based on announcements from TOCs or government agencies are as follows:

Transport for London (TfL). The closest prospect is an additional five Class 345 9-car Elizabeth line trains to serve HS2’s terminus (temporary or permanent) at Old Oak Common. For commonality, this would be placed with Alstom, and discussions with the DfT continue. TfL also has costed options for additional Siemens trains for the Bakerloo, Central, and Waterloo & City lines. As TfL is currently re-engineering the existing Central line trains, Rail Engineer expects only the Bakerloo option to be taken up and only then if there is funding available. The only other possible TfL order is approximately 25 new trams for its South London network.

SouthEastern Trains. New trains to replace the Networker units which date from the early 1990s are being considered. A notice seeking between 350 and 570 vehicles (DC EMUs with range extending battery power) was issued in November 2022. SouthEastern Trains updated this in October 2023 to indicate ongoing work leading to an ITT.

Great Western Railway. It was reported in November 2023 that options to either replace its diesel multiple unit fleet or give them a 10-year life extension are being considered.

Chiltern Railways. The possible replacement of its existing diesel fleet with new, environmentally friendly trains by 2030 was announced in July 2023. Chiltern Railways has also called for expressions of interest in supplying a number of existing vehicles which may replace the locomotive hauled trains such as displaced TPE class 68/mark 5 sets.

First TransPennine Express. In December 2023, the DfT announced an extra £3.9 million for the TransPennine Route Upgrade including 29 new trains to replace the existing fleet. Rail Engineer assumes that these will be bi-modes.

Northern Trains. In August 2023, it was announced that a framework is being sought to procure “across multiple call offs up to 450 units comprising multiple vehicles”.

Scotland’s Railway. A programme to replace all but the most modern trains in the Scottish fleet has been announced, starting with up to 550 suburban EMU or BEMU vehicles. It is understood that this order is delayed due to lack of finance.

SouthWestern Railway. In October 2022, it was announced that the replacement of the SWR Class 158/159 fleet with an “innovative self-powered solution” by 2030 is being explored.

What future for Derby?

At the December PTSC, Nick Crossfield advised that Alstom’s Derby plant was about to complete its big Aventra Programme that has supplied 2,500 vehicles to the Elizabeth line, Greater Anglia, South West, West Midlands, and c2c. Manufacturing of these trains finishes at the end of January when the Derby plant will go from an annual output of 650 cars, employing 3,000 people, to zero. This work also supports 15,000 in the local supply chain and spends £1.4 billion per annum. Nick advised that the paint contractor has gone into insolvency and that an on-site wiring loom supplier employing several hundred people has declared redundancies.

Alstom is in discussion with Government to find work for the Derby plant which could possibly be train refurbishment work. He considered it to be imperative that capability is maintained so that it can manufacture trains in 2027-2028. At the PTSC hearing, Nick’s passion for the plant and the retention of its skilled workforce was clear. He advised them: “Once you lose it, guys, you don’t get it back.”

However, he also advised that it was no problem for Alstom to supply UK trains should the Derby plant be substantially closed down. Trains could still be assembled in Derby but would have, for example, wiring looms from north Africa, pre-pressed flat pack body panels from China, and frames from central and eastern Europe.

Nick felt that the question for the UK right now is how it wishes to supply that market. He advised that there were two choices. One was a fully vertically integrated, embedded, manufacturing facility in the UK, with the required engineering and software capability that we need in this country to deliver those trains into service. The alternative is having an international supply chain with a light front-end finishing veneer in the UK.

The answer is obviously to maintain UK manufacturing capability. Yet by default, Government chooses the wrong answer as, in the absence of any meaningful rolling stock strategy, this choice was not addressed three-years ago.

Giving his evidence, RIA’s David Clarke stressed the need for a steady flow of work to give businesses the confidence to invest in people and plant. He noted that: “rational international businesses cannot hang around waiting for the good times when they are burning through cost today.” David also advised that cancelling HS2 phase 2 was an extreme example of how not to instil confidence in the market, as international investors, who don’t just look at the rail industry, are not going to have a great deal of confidence in future promises.

Where’s the plan?

Ten years ago, Rail Engineer (issue 115, May 2014) reported how a cross-industry group had produced its first Long Term Passenger Rolling Stock Strategy (LTPRSS). This strategy was then produced each year until the sixth and last one in 2018.

The Williams-Shapps plan for rail, published in May 2021 announced that the creation of Great British Railways which would, amongst other things set out a long-term Whole Industry Strategic Plan (WISP). This was to include rolling stock and be published in 2022. The GBR Transition Team (GBRTT) called for evidence to develop this plan. Its report on the submissions from the 307 organisations which responded was published in June 2022. Yet the plan itself has yet to be published and GBRTT is unable to advise of a publication date.

At a PTSC hearing on 15 November, Secretary of State for Transport Mark Harper committed to setting out a road map for rolling stock procurement by the 31 December. At the time of writing this has yet to appear.

In contrast, the PTSC was advised that the devolved administrations are clear about what they want to do. David Clarke noted that although in Scotland timescales are not certain due to the same fiscal challenges as elsewhere in the UK, the industry is able to plan for what is required when it comes to the market.

In the absence of a Government or industry strategy, the recommendations from the RIA rolling stock report shows what needs to be done. These include the requirement for Government to:

Make decisions in 2023 to allow the procurement and private financing of rolling stock upgrade or replacement of about 2,600 vehicles by 2030 .

Develop a long-term rolling stock and decarbonisation strategy, which should aim to smooth out ‘boom and bust’ to create the conditions for increased productivity and reduced whole life cost.

The UK’s mainline rolling stock fleet comprising of 16,000 vehicles, includes 7,187 new vehicles worth £14 billion according to the 2018 LTPRSS. Hence, the mainline fleet could be considered to be worth around £25 billion. In the absence of a plan, it would seem that there is no strategic long-term view of this high value asset. Nor, it would seem is there any strategic view of rail manufacturing capability which the RIA report shows to be a high productivity industry in which employees generate, on average, gross value added of almost £105,000. This compares to an average of £65,000 in the manufacturing industry.

RIA’s report also points out that, unlike infrastructure investment, new trains don’t need a large upfront public investment as the use of private finance to procure rolling stock is common practice. It makes clear that the current lack of orders will increase costs in the long-run as the lack of continuous production reduces productivity and reduces the skilled workforce. In addition, increasingly elderly trains will become significantly more expensive to operate and maintain.

Thus, the industry is not requesting for Government funds for rolling stock. It asks to be given the opportunity to reduce operational costs and protect its high-tech manufacturing industries. It is to be hoped that these recommendations will be acted upon soon.