Two years ago, Network Rail published its Traction Decarbonisation Network Strategy (TDNS) which proposed a rolling electrification programme of 13,000 single track kilometres (stk). Although the Department for Transport (DfT) has not responded to TDNS, it used it to inform its Transport Decarbonisation Plan which states that “we will deliver an ambitious, sustainable, and cost-effective programme of electrification guided by Network Rail’s TDNS.”

Yet is difficult to reconcile this plan’s statement with comments made at recent conferences by Rich Fisher of the Great British Railways Transition Team (GBRTT) and Network Rail’s Andrew Haines, both of whom stated that the UK Government’s 2021 Comprehensive Spending Review considered TDNS to be unaffordable.

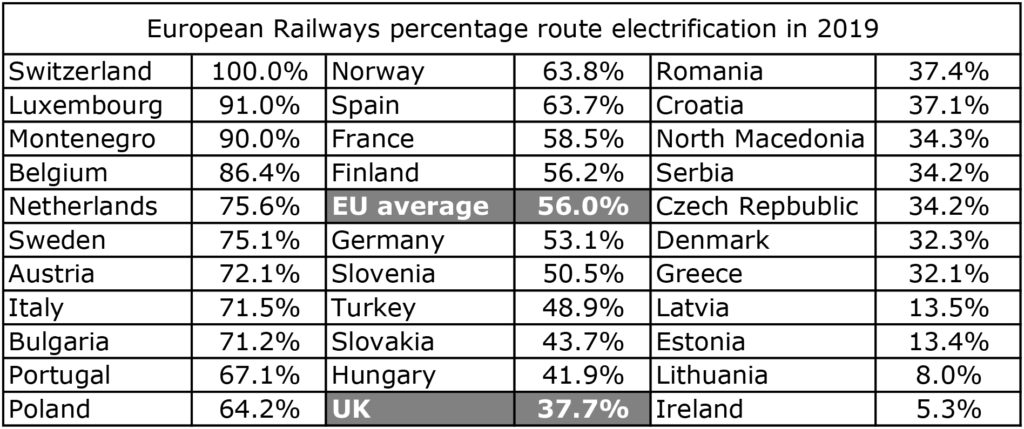

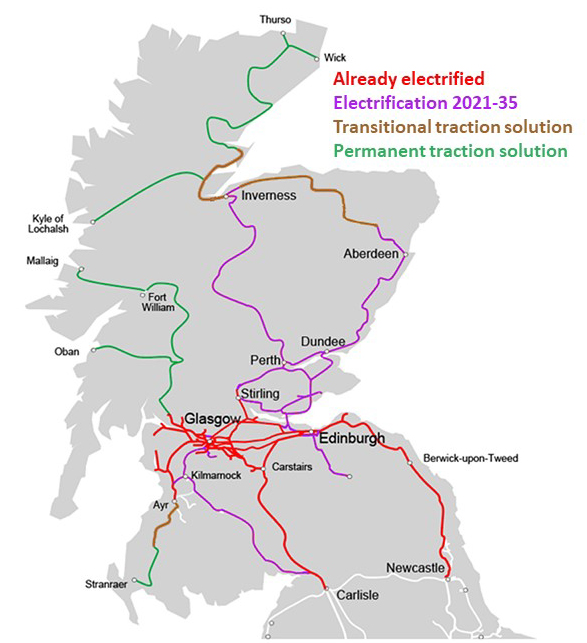

Thus, it seems that the UK Government has decided against a large-scale electrification programme. As a result, with only 46% of its tracks electrified, Britain will remain at the bottom end of the European electrification league table. In contrast, Scotland is committed to a rolling programme of electrification to decarbonise its railway by 2035. Transport Scotland’s view is it cannot afford not to electrify Scotland’s railway.

In this feature we consider why, in contrast to Europe and Scotland, the Westminster Government is reluctant to commit to electrification and whether rolling stock solutions are an effective decarbonisation option. To do so it is first necessary to consider some history.

Early electrification

In 1879 Werner von Siemens demonstrated the world’s first electric train in Berlin. This was a 150V DC locomotive hauling three small coaches. Its success inspired early electric railways which included the Volk’s Electric Railway in Brighton which opened in 1883 and is the world’s oldest operating electric railway.

Many railways were electrified in the first 20 years of the 20th century. With their power limited only by the capability of the supply, electric trains offered the high acceleration needed for suburban services and high power for heavy freight trains. Being inherently simpler and more efficient, electric trains also have lower maintenance and running costs.

During the interwar period, the Southern Railway adopted the 660V DC third rail system to electrify its suburban routes and lines to the South Coast. Largely as a result, Britain now has 4,536 stk of 650 DC third rail which now is 32% of the country’s electrified rail lines.

In 1932, a government committee decided that 1,500V DC overhead should be the UK standard, though few schemes were electrified in this way. These included Shenfield to Liverpool Street and the now closed Sheffield to Manchester line through Woodhead tunnel.

After the war

25kV AC electrification was introduced in Germany and France in the early 1950s. Its high voltage transmits a correspondingly higher power with lower transmission losses making it ideal for long distance railways that carry heavy traffic.

In 1956, British Railways (BR) adopted 25kV AC electrification except for third rail extensions. This was a brave decision given the constrained UK loading gauge and the lack of power semiconductors at the time which required the use of mercury arc rectifiers.

In 1960, Crewe to Manchester and the Glasgow suburban lines were electrified at this new standard. This was followed by lines from London to the West Midlands, Manchester, and Liverpool which were completed by 1967. This new electrified inter-city service was a spectacular success as passenger traffic increased by over 80%. This sparks effect was evident on subsequent BR electrification schemes.

This West Coast Main Line electrification was extended to Glasgow in 1974. A BR booklet commemorating its opening advised how electric traction was important “in these days of increased awareness of need to conserve world energy resources, notably oil”. At that time there was no mention of rail decarbonisation.

The 1970s energy crisis led to a system-wide electrification proposal which was rejected as railways did not have political support. Some electrification schemes such as Ayr, Bedford, and Kings Lynn were progressed around this time. This ensured that skilled electrification teams were not disbanded and available for BR’s largest electrification scheme, the East Coast Main Line. This was done in two phases, from London to Hitchin (1976 to 1978) and from Hitchin to Leeds and Edinburgh (1984 to 1991).

At 1983 prices, this cost £344 million of which £206 million was the electrification and the remainder for new trains. The project was only 3.8% over budget and eight weeks late on a seven-year programme. The cost of its electrification work at today’s prices was £668 million for 2,200 stk, or £0.3 million per stk, which is a fraction of current electrification costs. This is not an entirely fair comparison as since then there has been a significant increase in traffic and improvements in safe working practice. Nevertheless, much could be learnt from the way that the ECML electrification was delivered.

Electrification post privatisation

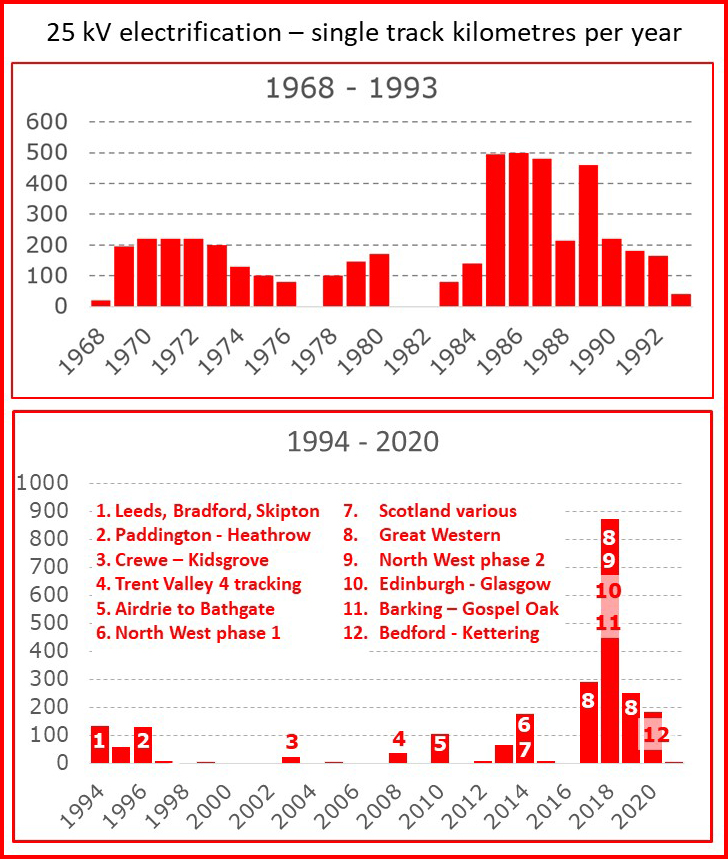

Though an average of 220 stk of electrification per year was delivered in BR’s final 15 years, the first 15 years of the privatised railway saw an average of 15 stk per year.

In 2007, the Government published its White Paper “Delivering a sustainable railway” which mentioned the need to reduce the railway’s carbon footprint. However, it considered that the case for electrification was not yet made, partly due to the possible development of low-carbon self-powered trains.

Three months later, the Chairman of the Association of Train Operating Companies (ATOC), Adrian Shooter, and Chief Executive of Network Rail, Iain Coucher, signed a joint letter stating that they believed the Government’s approach to electrification was wrong. Their succinct three-page letter explained why it was inconceivable to contemplate a 30-year strategy for rail which does not foresee much more electrification.

This and other lobbying had the desired effect as, in 2009, a £1.1 billion programme of rail electrification was announced. The Great Western Electrification Programme (GWEP) from London to Oxford, Bristol, and Swansea was to be completed in 2016. Electrification of the Liverpool to Manchester line was also to be completed by 2013.

2010 saw the first significant electrification project for 14 years. This was part of the reopening of the Airdrie to Bathgate line which was completed to time and budget. As the line was electrified as it was built, its electrification was at a significantly reduced cost with no disruption.

Cost overruns

Unfortunately, GWEP and other electrification schemes were significantly delayed and over budget. By 2016, GWEP was expected to be up to three years late with costs increased from £1.6 billion in 2014 to £2.8 billion, or £3.4 million per stk.

In 2017, GWEP was curtailed by omitting Swansea, Oxford, and Bristol. The planned Midland Main Line electrification was also cancelled. The statement advising these electrification cutbacks advised that because bi-mode trains could seamlessly transfer from diesel to electric power, there is no longer a requirement to electrify every line.

Also, that year, Government announced that the new East West Rail link would not be electrified despite the low cost of electrifying a railway as it was built. Instead, the use of alternative green energy traction was to be explored.

Thus, Government support for a long-term electrification programme was lost as cost overruns forced it to conclude that electrification is the wrong technology.

One of the reasons for the high cost of electrification is evident from the graph showing the electrification mileage delivered each year. After many years with hardly any electrification, the industry had to ramp up to deliver 800 stk of electrification in 2018. This was inevitably costly and inefficient with mistakes made due to skills shortages. In 2012, Rail Engineer reported that the plan was to have no less than 11 simultaneous electrification projects by 2016. In the event, at the peak of the programme there were only five concurrent projects!

Nevertheless, much of the responsibility for these cost overruns is within the rail industry. For example, unduly onerous design assumptions significantly reduced installation productivity. Piles were designed to be 12 to 15 metres long whereas long established empirical design guidance showed that they only needed to be 3 to 4.5 metres long. The 2019 Railway Industry’s Association’s Electrification Cost Challenge Report provides a thorough study of electrification costs during this period.

In Scotland, electrification of the Edinburgh to Glasgow main line (EGIP) was also in difficulty. Yet here the response was to ensure that the lessons were learnt rather than cancel electrification schemes. Scotland now has a rolling electrification programme with recent projects delivered to time and budget.

Decarbonisation reports

In February 2018, the then Rail Minister, Jo Johnson called on the rail industry to advise how it will decarbonise. His speech focused on innovation and made it clear that alternatives to electrification had to be considered.

The Rail Industry Decarbonisation Taskforce submitted its initial 68-page report in January 2019. This emphasised the need to maximise use of the existing electrified network using batteries to bridge gaps and called for further research and innovation into green traction technologies.

Its final 68-page report was completed in July 2019. This reached the rather obvious conclusion that rail decarbonisation required a judicious mix of cost-effective electrification, battery, and hydrogen trains. The report noted that 4,000 route kilometres of electrification may be required but only on page 34. This key conclusion was not mentioned in the executive summary.

In July 2020, Network Rail published its Traction Decarbonisation Network Strategy. This concluded that an additional 13,000 stk of electrification was required with hydrogen and battery trains operating on, respectively, 1,300 and 800 stk of the network. Its business case for various rates of electrification were appraised over a 90-year period as agreed with the DfT. One option to achieve net-zero carbon by 2050 required electrification of 355 stk per year. For this option, present value costs were between £6.3 and £9.7 billion and present value benefits were between £6.9 and £7.3 billion.

Hence, TDNS concluded that its net-zero by 2050 option had a net present value of between minus £2.8 billion and plus £1.0 billion. However, in accordance with DfT guidance, this does not include capital cost savings for cheaper electric trains. The capacity benefits of electric traction were also not considered.

In April 2021, the Railway Industry Association (RIA) published its ‘Why Rail Electrification Report’ which explained why electric traction is a future proof technology that will always be more efficient, powerful, and cheaper to operate than self-powered traction. This report was peer reviewed by members on the Institution of Mechanical Engineer’s Railway Division and sent to the Minister of Transport with a covering letter signed by 17 industry bodies.

Train costs

In March 2022, Britain’s passenger train fleet consisted of 15,277 vehicles worth roughly £25 billion. Yet there seems to be no strategic overview to get the best value from this asset.

The 2018 Long Term Passenger Rolling Stock Strategy (LTPRSS) shows that, since 2014, the DfT and individual train operating companies have ordered 7,187 vehicles at a cost of £13.8 billion – an average vehicle cost of £1.9 million. In 2014, the fleet size was 12,647 vehicles so these orders increased the fleet size by 2,650 vehicles. Although some of the new vehicles replaced life expired vehicles, the 2018 LTPRSS shows they left 3,940 serviceable vehicles surplus to requirements. Of these 889 were built since 1994 including 487 AC EMUs that could have operated under the wires of cancelled electrification projects, enabling diesel trains to be cascaded elsewhere to reduce the requirement to build new diesel trains.

Thus, about a billion pounds has been wasted due to such large numbers of serviceable vehicles being surplus to requirements. Storing them would have required 19 kilometres of sidings with significant further expenditure to keep them in a serviceable condition. It is doubtful if the opportunity to use surplus serviceable EMUs was a factor in the decisions to cancel electrification projects.

Cheaper electric trains

The 2014 LTPRSS considers that maintenance and leasing costs of electric trains are 37% less than those of diesel trains and that the annual electrification rolling stock savings from its high electrification scenario (equivalent to TDNS) would be £479 million.

In a recent presentation on ScotRail’s fleet strategy, the total operating costs per mile of electric and diesel vehicles were shown to be respectively £1.21 and £1.94 per mile. This is a 38% saving which is consistent with the LTPRSS figure.

Electric trains also have a higher maintenance availability. The LTPRSS also showed average availability for electric and diesel fleets to be respectively 91% and 88%. As a result, 3.8% fewer electric trains need to be purchased than diesel trains. Further fleet savings are possible with infill electrification that would allow electric fleets to be used more efficiently.

In recent times there has been a focus on rolling stock decarbonisation solutions to avoid the need for electrification including diesel bi-mode trains. These have duplicated traction systems which are more expensive to buy, maintain and operate. They also have less power when in diesel mode than conventional diesel trains and have higher track access charges as they are heavier than single power source trains.

Battery bi-modes also have a significant cost and weight penalty. An 8-car battery bi-mode on a half-electrified 250-kilometre route may require batteries weighing 9 tonnes costing £2.7 million as they are replaced every 5 to 10 years. These indicative figures are derived from having a battery of 60% of the 3,000kWh needed for Class 800/3 between London and Cardiff and rail traction batteries costing £1,500 per kWh and weighing 15kg per kWh. ScotRail consider’s that the per mile cost of a battery EMU is 18% more than a conventional EMU.

Why electrify?

Electric trains offer a future-proof technology as self-powered traction must carry its own fuel and convert it into electrical power with unavoidable efficiency losses. Furthermore, the power of electric trains is limited only by current that can be drawn from the overhead wire. For these reasons, the promotion of alternative self-powered traction to avoid electrification work is generally misguided.

This also explains why railways throughout the world consider electrification to be a worthwhile investment as it offers a more cost effective, higher performing railway. Hence, the 2009 Coucher / Shooter letter told Government that it was wrong not to be considering a long-term electrification programme.

This letter also advised that Network Rail was developing an Electrification Route Utilisation Strategy (RUS) with a thorough technical, economic, and environmental assessment of the pros and cons of a wider electrification programme. This estimated the Benefit Cost Ratios (BCR) for its proposed electrification schemes which included a BCR of 3.1 for Basingstoke to Exeter and a BCR of 5.1 for Cross Country (Doncaster to Plymouth, Birmingham to Basingstoke).

Electrification also offers particular benefits for railfreight as electric locomotives are typically twice as powerful as diesel locomotives. Hence, it offers heavier and faster trains with increased network capacity by reducing the performance differential between freight and passenger trains. Currently, electricity provides only 4% of the energy for UK rail freight compared with 56% in continental Europe. Studies have shown that an electrification programme of around 700 stk (5% that proposed by TDNS) would enable about 70% of rail freight to be electrically hauled.

Decarbonisation is a relatively recent priority and should not be seen as the prime reason for electrification. Most of the world’s electric railways were authorised before carbon savings became an issue. Nevertheless, greenhouse gas (GHG) savings which are valued at £241 per tonne in the Treasury Green Book increase the profitability of electrification. Current railway diesel GHG emissions are 1.3 million tonnes CO2e per year, thus eliminating these is worth £313 million per year. Therefore, over 25 years, the average GHG saving per kilometre of the 13,000 stk TDNS electrification programme is £0.5 million per stk.

GBRTT’s plan

Having been told that the TDNS electrification plan is unaffordable, GBRTT is developing a decarbonisation plan which is a mix of targeted electrification and extensive use of diesel and, eventually, battery bi-mode traction. It recognises that this will not achieve the target of net-zero traction by 2050.

Phase 1a of this plan is delivery of 900 stk of currently committed electrification schemes and the procurement of diesel bi-mode trains to increase their vehicle mileage to 20% of the passenger fleet. This is estimated to save 55% of traction carbon emissions with minimal rail freight emission savings.

Bi-mode traction offers a relatively quick carbon reduction as it eliminates diesel traction under the wires. It also offers operational flexibility as routes are electrified and so is a useful decarbonisation transitional technology. However, it has higher capital and operational costs as well as poorer performance than electric traction.

In the final phase of the plan, possibly completed by 2070, there would be minimal use of diesel traction. This envisages 6,900 stk of electrification including freight infill lines and battery bi-modes accounting for 11% of passenger vehicle mileage. By this time, emissions will have been reduced by 80% with a 35% drop in freight emissions.

The Williams – Shapps report states that Great British Railways is being set up to take “strategic decisions that take a view across the whole system”. Yet GBRTT has not been allowed to do this for long-term traction policy which would help ensure a safe, cost-effective railway with the lowest possible emissions and sufficient capacity, reliability, and performance. Instead, by ruling out a rolling electrification programme, the UK Government has, in effect, decided what constitutes cost effective railway without any apparent analysis comparable to TDNS or Network Rail’s 2009 electrification RUS. This decision is likely to result in many poorer performing trains with significantly higher operational costs.

The history of UK rail electrification has had various ups and downs. One particularly noteworthy aspect was how, in 2007, the industry was able to convince Government to change its strategy after a letter from ATOC and Network Rail telling Government that its approach to electrification was wrong. This Coucher / Shooter letter stressed that electrification “is an area that, perhaps above all others in rail strategy, is deserving of a serious and dispassionate analysis of the commercial, economical, and environmental benefits of the options.”

Fifteen years later, these words are particularly appropriate.