In this feature I set out the argument for revitalising rail freight against a background of changing passenger travel patterns after the pandemic. Whilst the end of lockdowns and opening up of the economy has seen increased ridership, the patterns of travel have changed, and overall demand has remained suppressed. It is clear that significant and permanent changes to railway services will inevitably follow with timetables reduced compared to pre-pandemic.

Furthermore, the relevance of the railway from the mid-21st century onwards is not guaranteed. My view is that the railway unduly prioritises passenger trains above freight. A container train conveying £20 million of time-sensitive goods is surely more important than a lightly-loaded passenger service.

Hence, a rebalancing of those priorities is needed to recognise the importance of rail freight and so secure the railway’s future and its ability to contribute to the economic and ecological wellbeing of society at large.

60 years of reshaped railway

In 1963 Dr Beeching published his report, ‘The Reshaping of British Railways’. Whatever might be thought of the man, it is undeniable that by that time the railway had to change.

His report is remembered for its proposed large-scale closures. Yet Beeching arguably saved the railways as his report laid the foundations of the modern railway by proposing container trains and the inter-city passenger network. Beeching recognised that railways have high fixed costs that offered great benefits when intensively used.

At that time road haulage was an economic growth area and the motorway network was being built to encourage this modal shift away from rail. By 1963, parts of the M1, M5, and M6 had opened and there were 200 miles of motorway. Now there is a motorway network of 2,300 miles. Last year, the freight carried by HGVs amounted to 154 billion tonne km which compares with 18 billion tonne km carried by rail.

In the early sixties, the large workforce, wagon fleet, and rail network provided for goods traffic could not be sustained. Hence, over six decades our railways have become increasingly passenger centric. Our railways in general no longer seek to provide for mixed traffic during the day, and the conflict with maintenance access constrains freight operation at night. Last year, freight trains travelling 8 million miles had to be fitted amongst 473 million miles of passenger train journeys.

As a result, from the freight industry perspective, the transport infrastructure investment has become skewed towards roads with rail investment largely prioritised towards passengers to improve journey time and increase capacity.

In November 2021, the Integrated Rail Plan (IRP) for the North and Midlands devoted just one page to rail freight for which it had no proposals. It cancelled two proposed high-speed lines: HS2’s eastern leg and Northern Powerhouse Rail’s proposed new line from Manchester to Leeds via Bradford which would have created extra freight capacity on the existing network.

A positive aspect of the IRP is that the Trans-Pennine Route Upgrade (TRU) is now moving towards inclusion for freight by clearing the route to W12 gauge. That is cause for some comfort, and offers hope for the future, but the hurdles that have been crossed, and I suspect those yet to come, do not speak of a balanced 21st century approach.

Decarbonising freight

In 2019 the UK became the first country to make a legal commitment to net zero greenhouse gas (GHG) emission by 2050. Although the UK has reduced its GHG emission by 50% since 1990, there has been little change to transport emissions which are around 500 million tonnes CO2e each year, including international aviation and shipping. In 2017, rail traction and HGVs accounted for respectively 2 and 21 million tonnes CO2e.

Rail has electric trains which is currently the only technology offering low carbon high powered transport. This is one reason why Network Rail’s Traction Decarbonisation Network Strategy (TDNS) recommended a large-scale rolling programme of electrification. Yet, other than in Scotland, there seems to be no government support for this.

Other modes of transport need to be weaned off petroleum if they are be decarbonised. This is a particular challenge for high-powered transport such as HGVs. If these are to be decarbonised, a huge infrastructure investment is required, be it hydrogen fuelling stations, heavy-powered battery chargers with upgraded distribution networks, or overhead electrification.

It will be some years before the optimum HGV decarbonisation solution is determined and many years after that before that necessary infrastructure is provided.

Modal shift

Hence, a large shift from road to rail is particularly important. To be clear I make this argument from an economic as well as ecological standpoint. In the short term, this is the only way of significantly decarbonising the nation’s freight transport, especially container traffic which can easily be moved from road to rail. A 10% shift of road traffic to rail would save 3.6 million tonnes CO2e per year which is twice the railway traction emissions. Similar savings are to be had if more passengers shift to rail.

The Chartered Institute of Logistics and Transport (CILT) estimates that around 38% of HGV container traffic may be suitable for modal shift to rail. This includes almost all very long road hauls over 300km, a significant proportion in the 200-300km range, and some heavy bulk commodities and construction materials in the 100-200km range. This assumes that battery HGVs with a range of 200km will be used for shorter distance local and regional hauls.

The Government’s Transport Decarbonisation Plan (TDP) states that we will “support and encourage modal shift of freight to more sustainable alternatives such as rail.” It explains how HS2, and TRU will provide the required additional capacity, yet much more needs to be done. Of the 35 schemes in the Rail National Enhancements Pipeline, almost all relate to passenger services.

Furthermore, current HS2 plans will create bottlenecks. North of Crewe, for example, enhanced ‘classic compatible’ passenger services will compete with railfreight for the available capacity.

Deep sea and continental European container traffic offers significant rail freight growth potential and ports will enthusiastically switch to rail if the railway can adapt to provide the capacity to accommodate this pent-up demand.

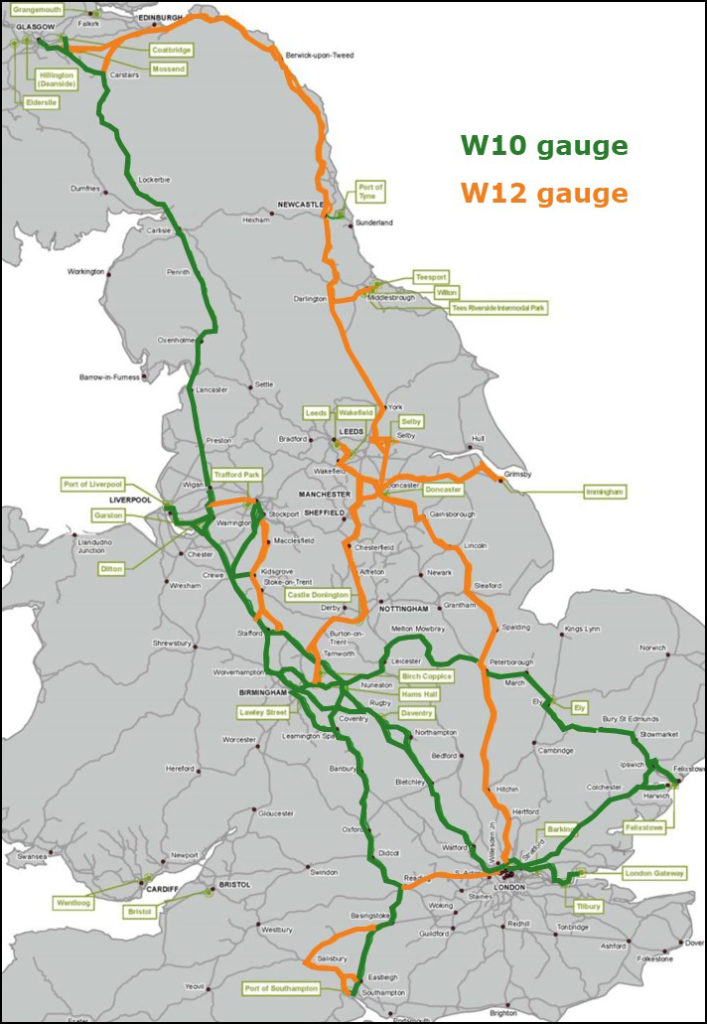

Much of this potential traffic cannot be accepted as the rail freight network is seriously constrained with significant gaps in routes cleared to W10 or W12 gauge. For example, there is no route for 2.5-metre-wide containers, from the Channel Tunnel to north of London and no East-West route between Lichfield and Edinburgh.

Freight gauging

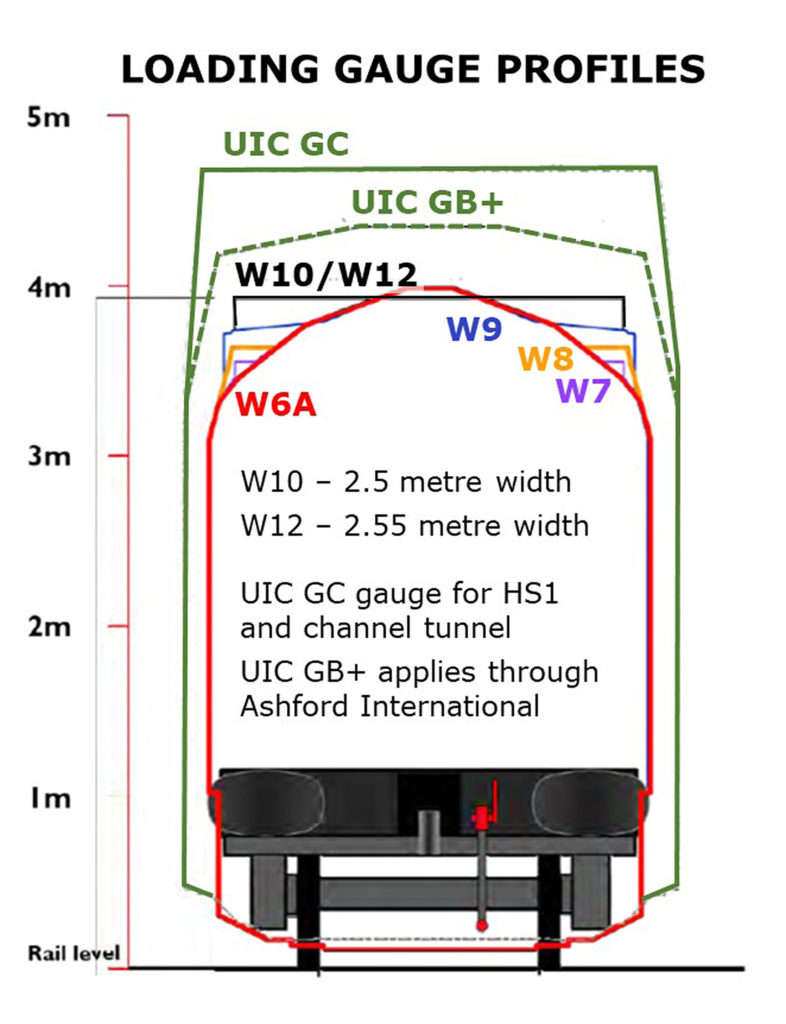

Gauge clearances through overline bridges and particularly tunnels are costly. Whilst the industry has relatively clear gauge categorisation in place, at the extremes, those categorisations are far from economically prudent. Hence, to minimise the cost and disruption, gauge dimensions need to be clearly defined.

Early in the post privatised railway it became evident that loading gauge definition was problematic. There was widespread confusion about matching vehicle and infrastructure gauges with gauge boards and polystyrene blocks commonly used to verify clearances. After much deliberation the “W” gauges were defined.

The railway’s dominant gauge is W6a for which most main line passenger trains are compliant. Bulk freight trains, certainly of modern construction, are compliant to W6a and thus need no great attention.

Containers, including swap body traffic, are a particular problem as they have no single set of dimensions. Furthermore, these are somewhat eccentrically defined with height and length being in feet and inches and width in metres. Containers by themselves do not entirely define the loading gauge as the vehicle deck, suspension and bogie centres are also highly influential. Hence gauging container traffic is a complex issue and leads to a tendency to safe option of adopting the largest standard gauge, W12. This is therefore a lazy approach which saddles freight route clearance business cases with costs for trains that will never operate on the route.

An alternative approach is to adopt probabilistic gauging. All the W gauges consider the vehicle size, shape, and extremes of dynamic movement. Defining the W gauge therefore takes the extreme value of every infrastructure and train tolerance to define the passing envelope. In contrast, probabilistic gauging applies a statistical approach to establish a probability of position for particular vehicles and so minimises the cost of route clearance for container traffic.

Such probabilistic analysis can significantly reduce the cost of gauge clearing tunnels and bridges. This technique is not a new or speculative science and is used in the aviation, atomic power, oil, and gas industries. However, despite having the technique being well developed, a curiously luddite attitude prevails in rail. That must change.

An update of the freight wagon standards is also required to avoid future wagon fleets breaching the gauge as determined by the combination of container and wagon sizes. Such specifications must define the maximum dimensional limits for deck height, suspension, and dynamic movement of today’s fleets and future fleets. Whole industry commitment for this, including RSSB, is essential.

Freight electrification

Electrification particularly benefits rail freight as electric locomotives are typically twice as powerful as diesel locomotives. This is because the power of an electric locomotive is limited only by the current it can draw from the wire, whereas a diesel locomotive’s power is limited by the available space for its engine and cooler group. Hence, a Class 92 electric locomotive can deliver 5,000kW at the rail whilst, Britain’s most powerful diesel locomotive, the Class 70 can only deliver 2,500kW. Whilst this is sufficient to haul main-line container trains, performance is limited when climbing steep gradients or accelerating to line speed.

Bi-mode locomotives have the flexibility to take power from the wires or diesel fuel. Yet they have limited spaced for an engine due to their electric traction equipment. It is understood that the recently ordered Class 99 bi-mode locomotives will only be able to deliver 1,600kW at the rail.

Electric locomotives can therefore haul heavier, longer, faster trains as well as increasing capacity by reducing the performance differential between freight and passenger trains. Currently, electricity provides only 4% of the energy for UK rail freight compared with 56% in continental Europe.

The CILT’s rail freight forum has concluded that 70% of rail freight could be electrically hauled if 700 single track kilometres (stk) of key freight routes were electrified. This is 5% of the TDNS’s proposed programme and would enable electric freight haulage of typically 28 x 3,000 tonne freight trains per day from the Mendip Quarries to London and container trains from Felixstowe (56 trains/day) and Southampton (48 trains/day) to Birmingham for distribution to the many West Midland distribution warehouses. It also includes a mere 2.5 stk to connect the port of London Gateway to the electrified network.

This approach is recognised and supported by the government’s TDP which states that it will purse “infill electrification which could allow a significant rise in the electric haulage of freight” and that “by 2050 all rail freight will be net zero.” However, these commitments are in doubt as recent statements by Network Rail and the GBR transition team indicate that the Treasury considers that TDNS’s large-scale electrification programme is unaffordable.

Prioritising freight

Mixing freight and passenger traffic on a busy railway is a significant operational challenge for which loops that enable passenger trains to ‘overtake’ freight trains are part of the solution. To adequately cater for this mixed traffic these loops need to be long enough to accommodate the maximum freight train length of 775 metres and their points need to have a reasonable entry/exit speed.

Between Preston and Carlisle, there are eight loops in each direction. Of these 16 loops only four can accommodate 775-metre freight trains. Turn out speeds through their 32 sets of points range from 10mph to 40mph. Half have a turn out speed of 20mph or less. The last thing a freight train driver hauling a 1,500 train at 75mph wants to see is a signal diverting his train over a 15mph set of points. This eats line capacity as the time taken to decelerate this train, pass the entire train over both sets of points at this speed and then accelerate back to 75mph is considerable, especially if the train is going up a gradient and is diesel hauled.

This also begs the question of whether freight trains should be looped to allow passenger trains to pass. It is not unreasonable to suggest that a heavily intermodal freight train should be considered to have more economic value than a lightly loaded passenger service.

Currently, each train has a four-digit train headcode in which the first digit denotes class and priority. Generally, classes 1 and 2 are express and ordinary passenger trains, 3 is used for parcels trains, 4 for 75mph freight and the remainder for freight of progressively lower speeds. This system was introduced in 1962 and is essentially unchanged after 60 years.

With much changed since this system was introduced, a review is needed to take account of the train’s economic, environmental, and social value. Average speed also needs to be considered. For example, a 75mph container train averages around 70mph on the southern section of the West Coast Main Line, whilst a stopping passenger train with a maximum speed of 110mph might only average 40mph.

A strategic plan

Rail freight companies and ports cannot on their own bring about the required modal shift to rail. Without gauge, traffic can’t be moved, yet the lack of current traffic makes the business case for intervention more difficult.

Without a strategic plan supported by the whole rail industry, progress will continue to be painful and slow with decision making repeatedly dragging through first principles. Slow progress and indecision will encourage investment in HGV decarbonisation experimentation. Yet no amount of innovation can change the fact that steel wheels on steel rails will always be many times more energy efficient than rubber-tyred HGVs.

To achieve this freight routes need to be prioritised in three categories. The first two are infill electrification routes and those that carry a high volume of freight traffic which are proposed electrification priorities as previously shown. The third category are the remaining lines of the core freight network which are:

- Church Fenton-Toton-Kings Norton,

- Bromsgrove-Westerleigh,

- Margam-Cardiff,

- Westbury-Southampton,

- Basingtoke-Laverstock,

- Westbury-Chippenham,

- Dore-Stalybridge-Stockport,

- Tunstead-Chinley,

- Swinton-Immingham,

- Northallerton-Redcar,

- Darlington-Eaglescliffe

An important component of the strategy must be the prioritisation of the required work to achieve the key priority maximising the shift of container traffic from road to rail. Freight traffic on rail, regardless of traction type, is better than diesel road haulage. Hence there should be no delay in facilitating that modal shift. The first priority should therefore be gauge clearance of the strategic freight network by the most economic means, including probabilistic gauging.

I believe that making the case for electrifying the whole strategic network is an unnecessary complication which damages the case for the good by pursuing the perfect, a folly not uncommon in rail projects over the past two decades.

Opening routes to container traffic flows will encourage the Rail Freight sector to progress locomotive fleet renewal with diesel bi-mode locomotives possibly fuelled by hydrated Vegetable oil (HVO) that can maximise the use of electric traction when under the wires. In service, those locomotives will allow unrestrained progress with volume growth to complete the modal shift. But unless the strategic plan is clear, the Rail Freight industry has no reason to specify and buy such locomotives.

As the plan rolls out, the benefits of modal shift will reduce road haulage and consolidate rail traffic volume growth to allow the business case for large-scale electrification to be developed.

The way forward

The totality of the plan will need to encompass many aspects not touched upon here. The Strategic Freight Network must connect the ports to distribution terminals where containers transfer between trains and electric HGV lorries for final distribution. Many of those distribution terminal locations already exist, but some are sub-optimal in terms of rail traffic planning and road connectivity. Hence new and relocated terminals will be required.

Considering the range of issues involved and developing a consensus within the rail industry, then driving the vision forward requires single minded leadership. The political turmoil of 2022 has provoked speculation over the commitment to the creation of Great British Railways (GBR), especially with the postponement of its enabling legislation. Cancellation of the GBR plan is likely to bring a prolonged period of uncertainty and planning blight. Perhaps that is the objective from the Treasury’s perspective.

Views about GBR vary, some are enthusiastic supporters others less so. Yet GBR represents an opportunity to engage all in the industry in moving forward with a strategic plan for freight and other changes the railway and the nation desperately needs.

Summary

Some may be surprised to find me seeing electrification as a second phase objective. I have three reasons for recommending this approach:

- The pressing need is to get freight off the roads on to rail. Sorting out the gauge largely achieves this and should be the focus.

- Electrification works have been deeply flawed over recent control periods. Whilst there are signs of a willingness to address this, much remains to be done. Until good programme discipline, much reduced costs and improved cost control can be demonstrated, electrification estimates will have high costs. This will damage rather than help the case for both freight and electrification.

- The separation of works as individual programmes will prevent the development of over-scoped route modernisation models becoming a block to rapid achievement of the modal shift.

In summary, I believe the rail industry has the opportunity to produce a plan for a Strategic Freight Network for which early industry wide commitment is needed. This plan must:

- Deliberately reject the industry enthusiasm to turn schemes into route modernisation programmes; it is better to tackle works incrementally over time.

- Concentrate on maximising the modal shift of container traffic from the ports onto rail by prioritising gauge clearance work to open routes and allowing diesel locomotive operation to aggressively drive the modal shift.

- Base gauge works on probabilistic gauging, allowing for future electrification to minimise the cost.

- Co-ordinate the specification of locomotives and container wagons as part of the strategic plan.

If this is done, the business case and roll out of electrification will follow as freight traffic growth consolidates.

Guest Writer – Peter Dearman

Peter Dearman is President of the Permanent Way Institution and is indebted to Julian Worth for his help in preparing this article.

About a dozen years ago, I did a consultancy job for Cummins in Darlington concerned with the testing of diesel engines.

One of their senior engineers told me about their design and manufacturing philosophy, where they would rearrange components of an engine to get even a moderate number of sales.

Cummins have recently, started offering families of diesel, hydrogen and natural gas engines, that are identical below the cylinder head gasket.

In a first for Stadler, the Class 99 is powered by a Cummins diesel. I suspect that after a few years, the cylinder head and fuel tanks will be changed and the engines will be hydrogen-electric hybrids. Have GB Railfreight have bought a decarbonation package?