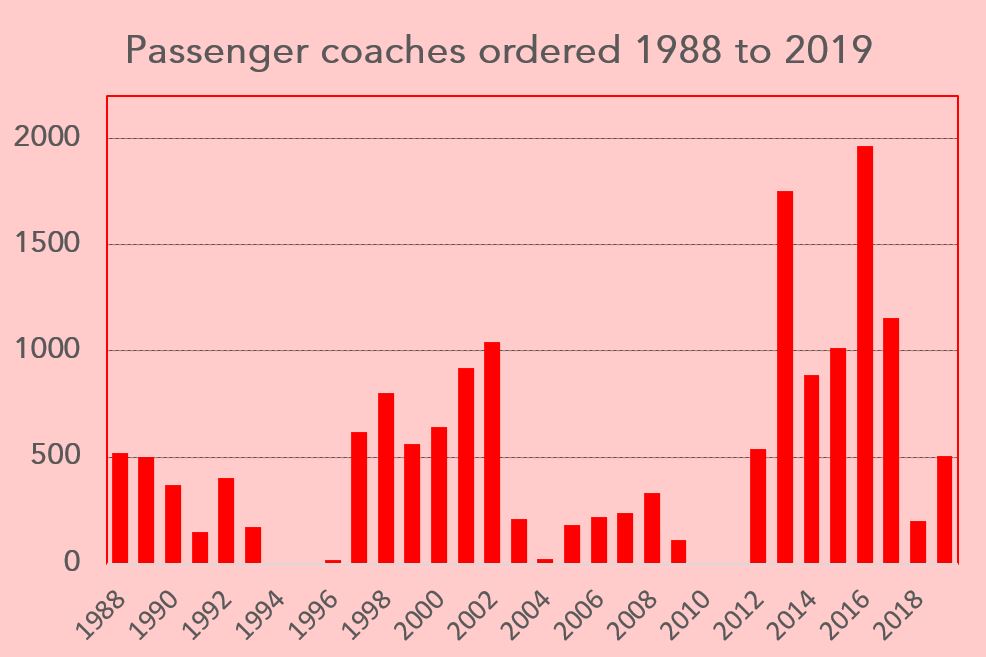

Since its first issue in November 2004, the pages of Rail Engineer have provided a perspective on rolling stock developments. Over the past 20 years, the passenger rolling stock fleet has grown from around 12,000 to over 15,000 vehicles. In the five years to 2004, new rolling stock orders averaged around 600 per year. Many of these trains had to replace Mark 1 stock due to the mandatory requirement for their withdrawal by January 2005 due to their poor crashworthiness.

After 2004, there was a significant reduction in train orders. A 999-day period with no orders ended in November 2012 when the DfT authorised the procurement of 26 x 5-car Class 377 units for the Southern franchise. After this, there was a glut of new trains with around 7,500 vehicles ordered before the end of the decade at a cost of well over £10 billion. This was due to three large Government procurements of the InterCity Express Programme, Thameslink, and Crossrail trains. Also, new franchisees placed many orders as a result of cheap finance and a new focus on quality when evaluating franchise bids.

These large train orders were good news for passengers who got newer, longer trains. However, they also displaced large numbers of serviceable rolling stock and the simultaneous introduction of these new trains was not without its problems.

In 2004, there were 808 mainline locomotives of which 116 were electric locomotives. There are now 732 locomotives including 68 electric locomotives. This decrease is largely due to significant reduction of the loco-hauled passenger services.

2004 to 2010

Loco-hauled passenger services on the West Coast Main Line ceased with the introduction of the full Class 390 Pendolino services which, for example, saw a 37% passenger increase between London and Manchester. In July 2005 we reported on an £8 million advertising campaign for this service including the technical challenge of producing its ‘The Return of the Train’ TV commercial incorporating clips from various classic films.

Although the 125mph Pendolinos speeded up services, at 140mph the Southeastern Class 395 units are the UK’s fastest domestic trains. One of the few train orders at this time was for 29 six-car Class 395 Hitachi units for the HS1 domestic service. In December 2007, Terry Whitley reported on their extensive testing programme. These trains were built in Hitachi’s Japanese Kasado plant and arrived in the UK in August 2007. Their initial tests had to be done within Signal Protected Zones on both Network Rail’s DC network and HS1. Terry gave a detailed description of these trains and their new depot at Ashford in August 2008.

At the time, perhaps few realised that these Class 395 units were the first of what is now over 1,800 Hitachi-built rail vehicles operating in the UK. The next step in this process was the news, as reported in our November 2006 edition, of Hitachi’s testing of electro-diesel technology on a special proving rig in Japan. This followed the DfT’s 2005 launch of the Intercity Express Programme (IEP) to replace the ageing InterCity 125 train fleet on Western and East Coast Main Lines, for which an invitation to tender was issued in November 2007. The value of this contract was £4.5 billion for trains consisting of 60 electric and 536 bi-mode carriages including their maintenance for 27.5 years. An option for a further 270 electric vehicles at a cost of £1.2 billion was taken up in 2013.

The contract for 1140 carriages of Thameslink trains was another large Government procurement exercise for which an invitation to tender was issued in November 2008. Siemens was announced as the preferred bidder in June 2011 and the contract was let in June 2013 for £1.8 billion. This included maintenance for 20 years.

In August 2009, we described how, for its Thameslink bid, Siemens had invested £50 million to develop its Desiro platform into the Desiro City Class 700. Much of this focused on weight reduction, with two tonnes saved on each bogie by reducing its wheelbase and the use of inside frames. The Class 700 has no internal doors to provide a wider corridor connection and a spacious feel. However, this requires intelligent air conditioning to vent smoke for an affected car and pressurise adjacent cars.

Noughties decarbonisation

Various features in our early magazines described environmental improvements and made the case for electrification, such as ‘Further electrification missed opportunities’ in the September 2006 edition. However, there was little mention of carbon. As early as July 2005 there was a ‘Hydrogen Power’ news feature which described how, in the US, designs were being developed for a hydrogen-powered light rail system in Detroit. In December 2007, Grahame Taylor’s ‘Fuel Wheeze’ feature described how a First Transpennine Express and Siemens initiative had reduced the fuel consumption of their Class 185 DMUs by 7% to save 1.8 million litres of fuel each year.

An energy saving measure for DC traction was covered in August 2008. This was enabling regenerative braking on the south of London third rail network, starting with Electrostar Classes 375, 376 and 377 units. This followed a cross-industry initiative involving Network Rail, Bombardier, Southern and Southeastern Trains. Rail Engineer’s first feature to mention the C word was a July 2009 report from an IMechE seminar: ‘Meeting the carbon challenge’. This considered the “soon-to-decline availability of oil” and addressed embedded carbon in train construction and on-train energy storage using flywheels, indicating the low energy density of batteries at that time.

Emitting less and using less of everything was the remit given to MTU for their engines to replace the Paxman Valenta as part of the life-extension of the then 30-year-old HST fleet. This was described in the August 2008 issue which also carried a report explaining the potential of the Long Marston facility which a property developer had recently purchased from the Ministry of Defence. Amongst the vehicles stored there were withdrawn Porterbrook-owned Class 87 electric locomotives which were receiving ‘E’ Exams before being exported to Bulgaria.

New train glut

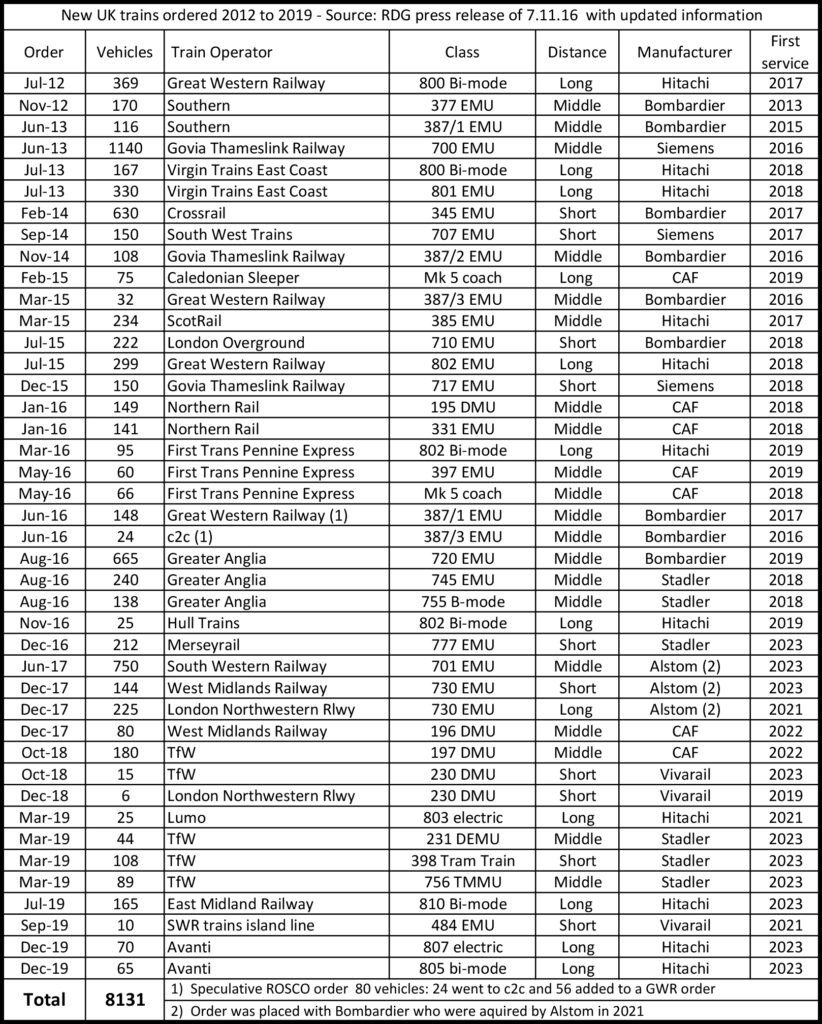

The 2010s saw orders for 8,131 passenger rail vehicles, over twice that of the previous decade. Vehicles ordered by manufacturer were: Alstom – 750; Bombardier – 2,484; CAF – 751; Hitachi – 1,844, Siemens – 1,440; Stadler – 831 and Vivarail – 31. In 2021 Bombardier Transportation was acquired by Alstom.

A third of these orders were the three big Government IEP, Thameslink, and Crossrail procurements. Bombardier won the Crossrail order with 70 x 9-car Class 345 Aventra units. The design of these units was described in the December 2015 issue whilst the March 2011 issue described how the Aventra platform had been developed to provide a more reliable and lighter train thanks to the FLEXX Eco inside-frame bogie.

Our April 2017 feature “New trains in their thousands” explained how this glut of trains was due to franchise quality considerations and cheap finance for orders totalling well over £10 billion. Many of these new trains were built in Britain, with over half the orders placed with Bombardier and Hitachi.

The large number of orders attracted Stadler and CAF as new entrants to the UK mainline train market with CAF building a train manufacturing plant in Newport South Wales. Ordering so many trains had its downsides. The 2017 Long Term Rolling Stock Strategy (LTRSS) predicted that the then UK fleet would increase to between 14,986 and 15,212 rail vehicles by 2019. It also considered that, when the current train orders are delivered, there will be a surplus of around 3,000 serviceable vehicles. Many of these were EMUs that were surplus due to cancelled electrification schemes.

As described in our May 2014 issue, the LTRSS was a useful publication that forecasted future passenger rolling stock numbers and highlighted the issues that need to be addressed to get the best use of the UK fleet. It was produced by a Rolling Stock Strategy Steering Group and published by the Rail Delivery Group. Unfortunately, its sixth edition, published in 2018, was its last.

These train orders resulted in mass extinction events as the new franchise holders as Greater Anglia replaced its entire fleet and South Western replaced its suburban fleet with a new fleet. In both cases this provided operational consistency and trains that were expected to be more economic to operate. However, it meant that these franchises had no further use for some quite new trains. For example, there is currently no use for 30 surplus ex-Greater Anglia Class 379 units that are just 12 years old.

There were significant delays with the near simultaneous introduction of these new train fleets which Malcolm Dobell considered in the December 2019 issue. Issues included the acceptance process, the challenges of new depots and providing sufficient stabling, training train crew and maintenance staff, and the benefits and challenges of modern software-driven trains including defining functionality and validation. Trains also have to demonstrate that they are compatible with the infrastructure on which they run. In this respect, one issue is that Network Rail is not incentivised to fix out-of-gauge infrastructure. The publication “New Trains – A Good Practice Guide” (available on the RDG website) was commended.

IEP and Thameslink

Rail Engineer has published various features covering the IEP programme. In December 2014, Rail Engineer magazine reported on its visit to Japan to see the first train unveiled at Hitachi’s Kasado plant where the first 13 trains were to be built to verify design and assembly of each train. Thereafter, all further trains were built at Hitachi’s Newton Aycliffe plant which opened in September 2015. Bogies, traction systems, and the ETCS signalling system were produced in Japan, as were the 26-metre-long aluminium bodyshells which were produced using friction stir welding.

In January 2017 we reported on the roll-out of the first IEP train built at Newton Aycliffe. At the time this plant was producing three vehicles a week with an eventual target of five per week. Our July 2017 edition reported how Class 802 bi-mode units were being produced at Hitachi’s Pistoia’s plant in Italy. This was an additional order for GWR for which there was no production capacity at Newton Aycliffe.

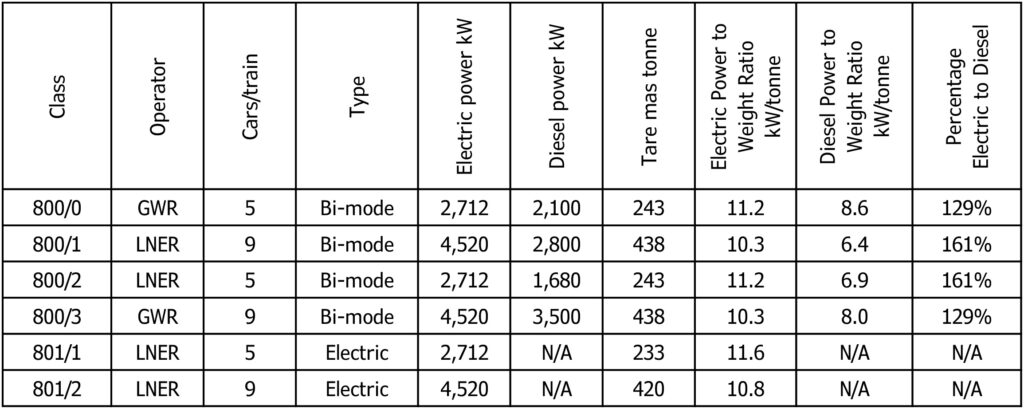

The introduction of such bi-mode traction was a controversial topic, especially as this had been used as an excuse to cancel electrification schemes. Such trains were felt to be “both unpowered diesels and overweight electrics”. Malcolm Dobell considered this in his November 2017 feature “Bi-mode trains: unlocking opportunity?”. He concluded that these trains’ self-powered performance is inferior to their electric performance and can also be inferior to the diesel trains they replace. However, they do provide the customer benefit of through journeys beyond the electrified network that would otherwise require a change of trains.

LNER uses the name “Azuma” for its new fleet of IEP units which means ‘east’ in Japanese. Our August 2019 feature reported how the first public Azuma service from Edinburgh averaged 105mph on a non-stop run between Newcastle and London, though this was nearly stopped at Grantham which provided an opportunity to demonstrate the Azuma’s impressive acceleration under electric power. It only took two minutes and five seconds to accelerate from 29mph to 100mph up the 1 in 200 gradient south of Grantham.

Rail Engineer was on the inaugural Azuma service from Inverness on 10 December 2019 and, in our January 2020 issue, reported how, in diesel mode, its balancing speed up to Slochd was 56mph. Between Inverness and Perth it was two minutes slower than the HST trains it replaced, though on the journey to London this was recouped by the Azuma’s better performance in electric mode. More importantly, between Inverness and London, the Azuma’s carbon emissions were around a third of the HSTs they replace.

Introducing new trains requires new and altered depots. For example, the Azuma fleet required a new depot at Doncaster, as Stuart Marsh reported in July 2019. Thameslink also required new depots for its Siemens Class 700 trains. Our May 2015 edition featured a detailed description of these new trains and their new depots at Hornsey and Three Bridges. In this issue, Colin Carr also explained how additional stabling was being provided for these new 115 trains which consist of 1,140 carriages that would be 23km long if laid end-to-end.

Other new trains

As well as building Class 80x trains, Hitachi was also building ScotRail’s Class 385 EMUs which were originally planned to be in service in December 2017. Our November 2017 feature described Hitachi’s Newton Aycliffe plant and explained how the Class 385 units were being built there. In April 2018 we described a ride on one of these units during one of its mileage accumulation runs when we were advised that, after demonstrating compliance with 2,000 clauses in the relevant standard, type approval was imminent. Alas this was not to be as, a few days after this run, ASLEF advised its members that the units were not safe to drive at night due to the curved windscreen which caused the driver to see duplicate signals. This, and some software issues, delayed the introduction of these trains until July 2018.

A trip to Spain to see how CAF was building 140 Class 195 DMUs and 141 Class 331 EMUs for Northern Rail at its Zaragoza plant was reported in the April 2018 edition. CAF had been selected for this £490 million order which was its first for a UK train and one of the largest it had ever received. It was reported that CAF won this order because they were able to build both diesel and electric multiple units on their Civity platform. When this order was received in 2016, CAF announced its intention to build a rolling stock plant in Newport South Wales which was completed in September 2018 and then began manufacturing Class 195 units. Since then, this plant has also manufactured Class 196 and 197 DMUs as Malcolm Dobell described in his July 2022 feature.

CAF also supplied Mark 5A coaches for Caledonian Sleeper and Transpennine Express as we describe in our July 2021 feature. These are amongst the small number of loco-hauled passenger trains.

Stadler is another manufacturer new to the UK train market. It won an order to replace Merseyrail’s Class 507 and 508 EMUs which were introduced in 1978 and are the oldest trains in regular UK Main line passenger service. Its offering is the bespoke articulated 4-car Class 777 EMU. In his May 2020 feature, Paul Darlington describes both these units and the infrastructure work to accommodate them. This included enhanced power supplies, platform alterations, an optical fibre and ethernet network.

The company won two more significant orders for trains with unconventional configurations. For Greater Anglia, its three and four car FLIRT Class 755 bi-mode units (in total 138 coaches) have an eight-metre power car in the centre of the train with a through corridor for passengers. In addition, 20 x 12-car Class 745 EMUs have coach pairs with articulated bogies. The issues associated with such long trains were addressed by our December 2019 feature on introducing new trains.

Greater Anglia also ordered 89 five-car and 22 ten-car Bombardier Aventra Class 720 EMUs. In his January 2021 feature, Malcolm Dobell describes the challenges of introducing these units. The original order for 22 10-car trains was later amended to 44 five-car units due to inflexibility of long fixed formation units.

For Transport for Wales (TfW), Stadler have provided 11 x 4-car Class 231 FLIRT DMUs, 7 x 3-car and 17 x 4-car Class 756 FLIRT tri-mode units powered either by 25kV OLE, diesel or batteries and 36 x 3-car Class 398 Citylink tram trains. This is part of a transformation of the TfW’s rail services as described in our July 2022 feature.

Locomotives

Whilst there are a small number of timetabled loco-hauled passenger trains as well as charter trains, the UK locomotive fleet is primarily for freight haulage of which most is hauled by 390 x Class 66 freight locomotives. In contrast to passenger fleet, there have been relatively few changes to the locomotive fleet since 2004. This includes a slight reduction, essentially due to the reduction in passenger train haulage. This particularly affected the number of electric locomotives of which there are now 68 compared with 116 in 2004. The electric locomotives are now only 9% of the total fleet.

The have been some interesting additions to the fleet. In May 2011 we described Freightliner’s procurement of the Class 70 locomotive which, at 2.75MW is 12% more powerful than the Class 66. This feature showed how the UK’s limited gauge and axle weight constraints were overcome to produce the UK’s most powerful locomotive. Yet this shows the limitations of diesel power as the Class 70 has only 55% of the power of a Class 92 electric locomotive.

In December 2013 we reported how Stadler was producing 34 x mixed traffic diesel Class 68 and 10 x bi-mode class 88 locomotives for Direct Rail Services. The 2.75MW Class 68 locomotives entered service in 2014 and have a maximum speed of 160 km/h enabling them to be used on passenger trains including hauling Mark 5A coaches on Transpennine Express services and Mark 3 coaches on Chiltern Railways. The Class 88 was a development of the Class 68 and is the first UK dual-mode locomotive powered from 25kV OLE. Its maximum power in electric mode is 4MW and 0.7MW in diesel mode.

In March 2021 we reported how the Class 88 was being developed further to become the Class 93 for Rail Operations (UK) of which 10 are due to be delivered in 2023. The Class 93 has the same 900kW diesel engine as the Class 88 but is also fitted with a 400kW Lithium Titanate Oxide battery to provide extra oomph whilst accelerating a freight train for short periods. During this time it will have the same performance as a classic 1.3MW Class 37 locomotive.

“56+66 equals 69” was the intriguing title of Malcolm Dobell’s July 2021 feature on how GB Railfreight managed to get a locomotive with performance of the no-longer produced Class 66. This described how it was possible to fit the 12-cylinder two-stroke diesel engine, as used in a Class 66, into a modified surplus class 56 locomotive.

Train technology

As well as features on specific classes of vehicles, we also covered more general aspects of rolling stock engineering, including those relating to accidents.

It is rare for a rolling stock failure to cause a derailment. Yet this was the cause of the serious derailment of an oil-tanker train at Llangennech, as reported in our January 2022 edition. This showed deficient wagon maintenance to be the cause and highlighted the importance of understanding basic engineering such as the nature of bolted joints and the importance of torque wrenches.

The crashworthiness of passenger vehicles in serious derailments over the last 40 years was considered in our July 2021 issue in response to ill-formed comments following the fatal Carmont derailment. This considered respective performance of Mark1 and Mark 2/3 coaches in these accidents and the nature of modern crashworthiness standards, to show that old Mark 3 coaches are not unsafe and have saved many lives in the past. This feature also showed how effective train protection has significantly reduced the number of accidents.

Although cracks on trains are an expensive cause for concern, this is a problem that can be safely managed. This was the conclusion of a two-part feature in the March and May 2022 issues which explained how cracks are caused. It also included a case study of the cracking on Class 80X units that may well cost more than £100 million to fix.

In complete contrast, in May 2015, Simon Tew’s “What is TCMS?” feature explained how a Train Control & Management System (TCMS) is a train-borne distributed control system. This comprises computer devices and software, human-machine interfaces, digital and analogue input/outputs capability and data networks that connect everything together. TCMS has many benefits which includes the reduction of train cabling. However, the complexity of software that affects everything on the train can be problematic, particularly during the introduction of new trains.

With the sensors and TCMS data collection and transmission fitted as standard on new trains, Remote Condition Monitoring (RCM) is offering significant reliability benefits. Train RCM was the focus of our January 2020 feature which also considered its application to older trains as well as the pros and cons of on-board and lineside monitoring.

Other electronics not seen on trains in 2004 were GSM-R radios and cab signalling (ETCS). GSM-R became fully operational in 2015 and was first mentioned in Rail Engineer in October 2008. The practicalities of fitting GSM-R cab radios were described in our March 2014 feature. All new trains are now fitted with ETCS or have passive provision for its fitment. A contract to fit ETCS to freight locomotives was signed in 2018. Currently ETCS is only operational on the Thameslink central core, Paddington to Heathrow and Cambrian lines.

Steel wheels on steel rails may offer the low rolling resistance that makes railways highly energy efficient. Their Achilles heel is the tiny contact patch which can suffer from alarmingly low adhesion. In a series of four articles up to May 2020, Malcolm Dobell considered various trials to reduce this risk. The result was validation of the effectiveness of Double Variable Rate Sanders (DVRS).

Rail Decarbonisation

Following the then Rail Minister Jo Johnson’s call in February 2018 for diesel trains to be phased out, there was an emphasis on innovations for rail decarbonisation. In December 2018 we reported on an RSSB conference which offered prizes for innovations for “intelligent power networks to decarbonise rail”. However, such prizes were only offered for initiatives that decarbonised self-powered traction and excluded initiatives that helped improve railway electrification.

Whilst there is certainly a role for decarbonised self-powered traction on secondary routes, there is a danger that excessive focus on such solutions might detract from rail electrification which is the only decarbonisation solution for most of the network. As we reported in November 2021, this was the case at COP26 in Glasgow when battery and hydrogen trains were lauded as trains for the future whilst they were surrounded by more efficient and powerful electric trains at Glasgow Central. However, posters at Scottish stations did proclaim that each of ScotRail’s electric train is a “Net Zero Hero.”

For many railway engineers, hydrogen trains are an unnecessary distraction. Yet this view does not take account of the need to develop the hydrogen economy that will be required to eliminate the use of fossil fuels. This was the focus of our September 2022 feature which explained how Scotland’s hydrogen train was a pilot scheme to assess how such trains could be part of a wider hydrogen economy.

Trains of the future

With HS2 becoming operational around 2030, its trains will be in service well into the 2050s and so will need to be adaptable for both future needs and emerging technologies. The procurement of these trains as specified in a 338-page Train Technical Specification (TTS) and the pedigree of those bidding for this contract was considered in a two-part feature in March and April 2019.

The TTS specified that HS2 trains will be made up of one or two coupled 200-metre-long units, each with up to 550 seats, that can accelerate from stationary to 360km/h, cover 40 kilometres in 535 seconds, and offer a journey time from London to Birmingham of 45½ minutes. It also specifies a mean distance between service affecting failures of at least 300,000km on the HS2 network and 150,000 on the conventional rail network.

Our feature considered the high-speed trains that have been built by Hitachi, Bombardier, Alstom, Siemens, CAF, and Talgo which showed how the UK is far behind the rest of the world in respect of high-speed rail.

In December 2021, it was announced that the £2 billion contract to build 54 x HS2 trains has been let to a joint venture of Hitachi and Alstom which acquired Bombardier Transportation in January 2021. Vehicle body assembly and initial fit-out, will be done at Hitachi’s Newton Aycliffe plant with fit-out and testing done by Alstom at Crewe and Derby. The first train is expected to be completed around 2027.

The next 100 issues?

HS2’s trains will certainly feature in the next 100 issues, though other rolling stock developments that might be seen before the 300th edition of the magazine are less certain.

The future passenger fleet will constitute self-powered, bi-mode, and electric traction, although its future mix is difficult to predict due to the uncertainty of future electrification. In Scotland there is a clear strategy of interim discontinuous electrification to enable the ageing diesel fleet to be replaced by battery electric units.

South of the border there are no plans for the replacement of old British Rail-built diesel units. The commitment to replace diesel-only trains by 2040 poses particular issues for rolling stock owners as any diesel trains ordered now will have barely more than 10 years life when they are delivered. This might result in trains with a flexible power source, such as the Stadler FLIRT units.

Yet the reality is that, for many routes, diesel rail traction is likely to be the only practical option without electrification. It is possible the hydrogen train fleets might be operational by 2040, though unless supported by a wider hydrogen economy, their costs may be prohibitive. Hence, without widespread electrification, the commitment to remove diesel-only trains by 2040 may be quietly dropped.

There are also many ageing EMUs that will soon need to be replaced, such as Southern’s networkers. It will be interesting to see what the next generation of EMUs will offer.

For freight, it is to be hoped that there will at least be some infill electrification that could significantly increase electric freight haulage. Yet as electrics constitute only 9% of the locomotive fleet, this would need rail freight companies to justify the cost of additional electric locomotives. In this respect, it is good to see that GB Railfreight has ordered 30 Class 99 bi-mode Co-Co locomotives that are due to enter service in 2025.

Another uncertainty is the ETCS programme and associated need to replace the 2G GMS-R with the 5G FRMCS (Future Railway Mobile Communications System).

Whatever the future holds, Rail Engineer will report it!